2019年6月12日,世界银行宣布对中国某公司进行制裁——15个月内禁止该公司参与世行融资支持的项目,到期并满足条件后才可以解除制裁。制裁的原因是其在利比里亚电力项目的投标中存在“欺诈行为”。该项目总投资6亿美元,建设内容为改善利比里亚电力供应并提升利比里亚电力部门的服务能力。被制裁公司被认定伪造两份信函,声称某设备生产商已经授权该公司提供、安装其设备。被制裁公司与世行签署了和解协议,承诺会按照《世界银行诚信合规指南》建立诚信合规体系,并将此作为解禁的一项条件。

On June 12, 2019, the World Bank announced that a Chinese company has been debarred with a conditional release. Due to “fraudulent practices” that occurred during a bid for a power project in Liberia, the electrical engineering firm will be unable to participate in World Bank-financed projects for 15 months. The project, worth USD 60 million, was to increase access to electricity and strengthen institutional capacity in Liberia’s electricity sector. The electrical engineering firm had falsified two letters asserting that the manufacturer of a type of equipment had authorized the electrical engineering firm to supply and install the equipment. The electrical engineering firm entered into a settlement agreement with the World Bank and committed to establishing an integrity compliance program consistent with the principles set out in the World Bank Group Integrity Compliance Guidelines[1]as a condition for release from its debarment.

由于对该公司的制裁期限超过了一年,该制裁事项自动触发了世界银行、亚洲开发银行、欧洲复兴开发银行、美洲开发银行、非洲开发银行等其他多边开发性金融机构的联合制裁——该项制裁机制是上述机构在《共同执行制裁决定协议》中确立的。这意味着,该公司也不能参与上述任何一家机构提供融资支持的项目。

As the World Bank debarment is longer than one year, the electrical engineering firm qualifies for automatic cross-debarment by other multilateral development banks (MDBs) under the Agreement for Mutual Enforcement of Debarment Decisions. The company will be unable to participate in projects funded by the Asian Development Bank, the European Bank for Reconstruction and Development, the Inter-American Development Bank, and the African Development Bank.

世界银行近期频繁制裁中国企业

The World Bank Has Been Busy Debarring Chinese Companies

本案是世界银行对中国企业进行制裁的最新案件。除该电气设备公司以外,近期还有其他三家中国公司被世界银行制裁而与世行签署和解协议:

This is the latest in a line of World Bank debarment cases involving Chinese companies. In addition to the electrical engineering firm, the World Bank has announced three other settlement agreements with Chinese companies recently:

2019年6月6日,世行宣布对某中国企业、该企业的两家子公司及其下属公司进行制裁,制裁原因是其在某格鲁吉亚建筑工程项目的投标过程中存在“欺诈行为”,具体包括对子公司的相关经验、人员配备、设备情况进行虚假陈述。由于制裁期限不满一年,该公司未触发其他多边开发性金融机构的联合制裁。 A Chinese company, two of its subsidiaries, and their affiliated companies were debarred for nine months on June 6, 2019, for “fraudulent practices” in the procurement process for a highway construction contract in Georgia. These practices included misrepresenting a subsidiary’s experience and the personnel and equipment to be used in the project. As the debarment is for less than a year, the companies do not face cross-debarment by other MDBs. 该公司及其子公司还可能面临24个月的附条件不予制裁。在不予制裁期间,该公司及其子公司可以参与世行项目。但是,如果其未能遵守和解协议,包括未能在规定限期内完善其合规体系,可能将会面临24个月的实际制裁。 The companies and their affiliates may face an additional conditional non-debarment for 24 months. During the non-debarment period, the companies and their affiliates will be able to participate in World Bank projects. However, if they fail to meet the conditions of the settlement agreement, including enhancing their integrating compliance program, they may be debarred for those 24 months.

2019年5月22日,世行宣布对中国某公司进行为期20个月的制裁,制裁理由是其在赞比亚的某输变电项目中存在欺诈行为,包括提交虚假文件谎报该公司的过往业绩。该制裁同样将建立合规体系作为解禁的一项条件。由于制裁期限超过了12个月,该制裁同时触发了其他多边开发性金融机构的联合制裁。 A Chinese company was debarred for 20 months on May 22, 2019 for "fraudulent practices" in a bid for improving part of an electricity transmission and distribution system in Zambia. These practices include misrepresenting the company’s past contract experience by submitting falsified documents. The debarment comes with a conditional release which requires the development of an integrity compliance program. The company qualifies for automatic cross-debarment by other MDBs.

2019年5月14日,世行宣布对中国某公司进行15个月的制裁,制裁理由是其在西非的跨境输变电项目的投标中存在欺诈行为,具体表现为虚构过往业绩以满足项目要求。制裁要求该公司在制裁期间继续全面配合世行廉政局。该制裁同时触发了其他多边开发性金融机构的联合制裁。 A Chinese company was debarred for 15 months on May 14, 2019, for “fraudulent practices” in a bid for a cross-border electricity transmission project in West Africa. These practices included falsifying its past experience to meet the requirements of the contract. The debarment comes with a conditional release that requires the company to continue full cooperation with the World Bank Group Integrity Vice Presidency. The company qualifies for automatic cross-debarment by other MDBs.

在上述4项制裁的和解协议中,有3项协议因为中国公司的配合和自愿采取补救措施而缩短了制裁时间。当公司涉嫌违反世行规定时,充分配合和自愿补救永远是被推荐的明智之举。如下文所述,企业配合世行调查能够显著地缩短制裁期限。2018年,许多外国企业被世行处以超过10年的禁令。由于世行和其他多边金融机构在全球范围内每年进行数十亿美元的基础设施建设投资,违规的中国企业越早回归参与到这些项目中就越有利。

Three of the settlement agreements include reduced debarment periods for the Chinese companies due to their cooperation with the World Bank and for undertaking voluntary remedial actions. Cooperation with authorities and voluntary remedial action is always recommended when compliance lapses come to light. As discussed below, cooperation can result in significantly shorter debarment periods. Some non-Chinese firms received World Bank debarments in excess of 10 years in 2018. As the World Bank and other MDBs hand out billions of dollars in contracts each year for projects across much of the world, the sooner Chinese companies can get back to participating in these projects, the better.

在上述4项和解协议中,有3项被制裁企业承诺了建立合规体系或者对现有合规体系进行改进。该项措施对中国企业大有裨益——它们不仅可以更好地符合中国、项目所在国甚至国际通行的法律与监管义务,更有机会进一步提升其经营成效。有效的合规体系也无数次的被证明对于提升企业业务成果大有帮助。中国在合规体系建设方面最新的法律制度(如《中央企业合规管理指引(试行)》《企业境外经营合规管理指引》)和不断增长的经济总量都在全国范围内掀起了大型企业优化合规体系的热潮,相关内容请参见我们近期关于全面合规体系建设的两篇拙文:

Three of the settlement agreements also included a conditional requirement to establish an integrity compliance system or enhance an existing one. This should actually be beneficial for the Chinese companies - not only will they be better positioned to meet their legal and regulatory obligations, whether domestic, foreign, or international, but they will also have the opportunity to improve their business performance. It’s been shown time and time again that strong compliance systems contribute to improved business outcomes. The improved economic outcomes combined with new Chinese laws on compliance systems has contributed to a China-wide trend for large enterprises to establish or improve their compliance system. If you’re looking for a place to start, please check out two of our recent articles on establishing compliance systems:

我们将在下文概述世界银行的制裁程序,以期为正在面临或未来可能面临世行制裁的企业提供参考。

For those looking to find out what they can except if their company is under investigation by the World Bank or will soon be under investigation, we have included an overview of the World Bank’s sanction process below.

世界银行制裁程序概览

Overview of the World Bank’s Sanction Process

世界银行的制裁程序旨在履行其协议条款项下规定的受信义务,以确保世行受托管理的资金用于指定用途。世行主要通过以下方式实现这一目的:(1)制裁,即将违规的公司或个人排除出世行融资的项目之外;(2)阻却,即通过反向激励企业在未来从事被制裁行为,减少世界银行资金未来的风险。这些遏制手段是违规行为需要承担的代价,包括附条件解除的制裁、不予制裁,赔偿,或其他补救措施。

The World Bank’s sanction regime exists to uphold the World Bank’s fiduciary duty under its Article of Agreement to ensure that the funds entrusted to it are used for the purposes intended. The World Bank primarily accomplishes this through (1) debarment, which excludes offending companies and individuals ( “respondents”) from World Bank projects funds and (2) deterrence, which reduces future risk to the World Bank’s funds by “disincentivizing” companies from engaging in sanctionable practices in the future. These disincentives are the price for misconduct, including meeting the conditions of release from debarment or non-debarment, restitution, or other remedies.

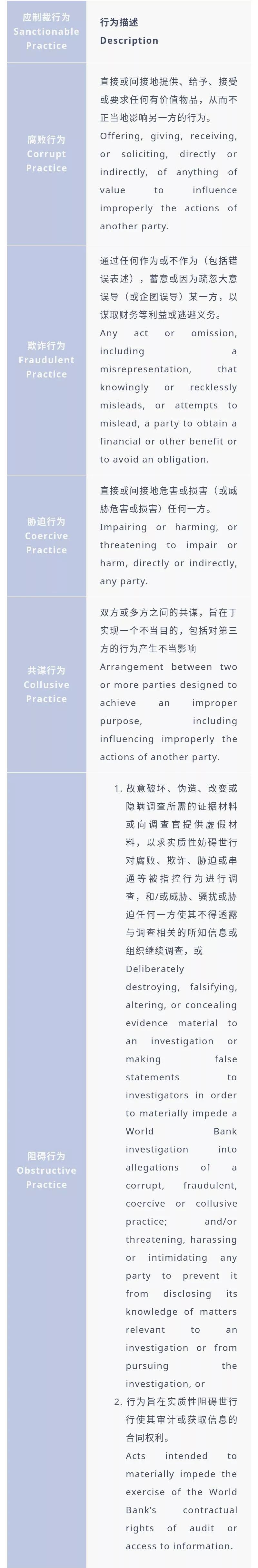

应予制裁的行为

Sanctionable Practices

世界银行列明了五类应予制裁的行为:腐败、欺诈、胁迫、共谋、妨碍行为。欺诈行为是导致调查的最常见的原因,上述四家中国企业也都是因此被制裁的。

The World Bank categorizes five sanctionable practices: corruption, fraud, coercion, collusion, and obstruction. Fraudulent practice is the most common allegation that leads to investigations and is the cause of all four of the aforementioned Chinese companies’ debarment.

制裁的类别

Types of Sanctions

世界银行有着广泛的制裁手段,能够很好地保护其资产以履行其受信义务。制裁手段包括制裁、附条件解除的制裁、附条件的不予制裁、谴责信、永久制裁。

The World Bank has a wide range of sanctions available to fulfil its fiduciary duty to protect its funds. This includes Debarment; Debarment with Conditional Release; Conditional Non-Debarment; Letter of Reprimand; Permanent Debarment; and Restitution and other Remedies. We will discuss these in order.

当存在多种违规行为竞合的时候,各违规行为会被分别考量、累加制裁。要分别考量,必须有明显的违规行为事件,无论是在不同项目上的违规行为,还是在明显不同的时间内同一项目上的违规行为。

When there is cumulative misconduct, each separate incidence of misconduct may be considered separately and sanctioned on a cumulative basis. To be considered separately, there must be distinct incidents of misconduct, either misconduct on different projects or on the same project at significantly different times.

A、附条件解除的制裁

Debarment with Conditional Release

对于所有的违规行为,制裁基本是为期三年的禁止,并附条件解除。这一制裁通常是适用于下述的其他制裁没有其他考虑的情况。有条件解除是为了鼓励违规公司的恢复,并减轻对世行活动的进一步风险。被制裁对象只有在制裁期结束后,并证明他们已经满足解除条件,才会被解除制裁。即使满足解除条件,也不能提前解除制裁。但是,符合特定条件,如采取合作或补救措施,有利于缩短制裁期。如前所述,如果发现合规疏漏,强烈建议各企业与世行合作。

The base sanction for all misconduct is a three-year debarment with conditional release. This is normally applied if there is no other consideration for other sanctions described below. Conditional release is to encourage the offending company’s rehabilitation and mitigate further risk to World Bank activities. Respondents will only be released from debarment after the debarment period lapses and they demonstrate they have met the release conditions set for them. Respondents cannot be released from debarment earlier even if they meet the release conditions. However, compliance with specified conditions, such as cooperation or remedial measures, may result in a reduction in the debarment period. As we mentioned before, it is highly recommended that companies cooperate with World Bank authorities if compliance lapses are found for.

对于制裁期超过10年的公司有一个例外情况——如果符合解除条件,他们可以在10年后申请减少制裁期限。

An exception exists for companies with a defined debarment period of over 10 years- they may petition for a reduction of the debarment period after 10 years if they meet the release conditions.

施加的条件可能包括:

Conditions imposed may include:

实施或改进诚信合规计划;以及 Implementation or improvement of an integrity compliance program; and

采取补救措施来解决违规行为,包括纪律处分或解雇相关负责人。 Remedial measures to address the misconduct for which the respondent was sanctioned, including disciplinary action or termination of those responsible for the misconduct.

B、制裁

Debarment

如果没有合理的目的,世行有时会对不符合条件的调查对象施加制裁。这种情况可能发生在受制裁的公司具有健全的公司合规实践,违规行为涉及已被解雇的一名或多名员工的单独行为,并且制裁期限相对较短,通常为一年或更短。

Sometimes the World Bank will debar respondents with no conditions if there is no reasonable purpose served by imposing conditions. This may occur if a sanctioned firm has a robust corporate compliance practice, the misconduct involved isolated acts of an employee or employees who have already been terminated, and the proposed debarment is for a relatively short period of time, usually one year or less.

C、附条件不予制裁

Conditional

Non-Debarment

一般来说,附条件不予制裁适用于两种情况下的公司。第一种情况为公司不直接参与作为调查对象的关联公司的不当行为,但该公司仍对其关联公司的行为承担部分责任。例如,母公司缺乏对子公司的系统监督。第二种情况是,调查对象证明其已采取了“全面的纠正措施”,并且有此类其他的减轻情节(如下文所列)证明不该受制裁。

Generally, conditional non-debarment is applied to companies in two circumstances. The first circumstance involves a company that is not directly involved in the misconduct of an affiliate company that is a respondent, but the company still bears some responsibility for the respondents actions. An example would be a parent company’s systematic lack of oversight of a subsidiary. The second circumstance is when a respondent has demonstrated that it has taken “comprehensive corrective measures” and that such other mitigating factors (listed below) justify non-debarment.

附条件不予制裁所要求的条件与附条件解除的制裁下规定的条件相似。如果被制裁方未能在规定的时间内证明符合条件,则不予制裁期自动转为制裁期。

The conditions imposed will likely be similar to those imposed under debarment with conditional release. In the event that the sanctioned party fails to demonstrate compliance with the conditions within the established time periods, the non-debarment period automatically becomes a debarment period.

D、谴责信

Letter of Reprimand

谴责信最常被用来制裁因监督不足而只犯个别违规事件的关联方。

A Letter of Reprimand is most often be used to sanction an affiliate of a respondent that was only guilty of an isolated incident due to a lack of oversight.

E、永久制裁

Permanent Debarment

永久制裁是一种很少规定的制裁,在“没有合理理由”认为调查对象可以通过合规或其他条件得以恢复的情况下使用。这通常适用于自然人、自然人控股的公司和空壳公司。

Permanent debarment is a rarely prescribed sanction that is used when there is “no reasonable grounds” for thinking that a respondent can be rehabilitated through compliance or other conditions. This is most commonly applied to natural persons, closely held companies by natural persons, and shell companies.

F、赔偿与其他救济

Restitution and other Remedies

在特殊情况下,包括欺诈需要向客户国家或项目归还大量资金时,可以使用赔偿金以及财务等其他补救措施。

Restitution, as well as financial and other remedies, can be used in exceptional cases, including when there is fraud that requires a significant amount of money to be restored to the client country or project

减轻或加重情节

Mitigating and Aggravating Factors

企业在应对世行调查或即将面临世行调查时,最重要的事情之一就是尽量减少可能加重处罚的情形并采取增加减轻处罚的措施。高效且适当的措施有很大可能减少制裁期限。下表列明世行决定对被调查对象进行制裁时,可能考虑到的加重或减轻情节。

One of the most important things a company that finds itself under a World Bank investigation or suspects that it will soon be under investigation, is to consider taking actions that will reduce aggravating factors and increase mitigating factors. Quick and appropriate action can potentially shave years off a debarment period. The tables below list the mitigating and aggravating factors the World Bank considers when deciding on the appropriate sanction for a respondent.

结 语 Conclusion

显而易见,中国企业正处于世界银行监管部门的严格监管中。如果贵公司正在或将要接受世行的调查,我们强烈建议开展全面的内部调查,最好是与外部律师合作,以确定所有指控的真实性;如果指控属实,则寻求最有利的结果。

It’s clear that Chinese firms are finding themselves under the strict watch of World Bank regulators. If your company finds itself or expects to find itself involved in a World Bank investigation, we highly recommend that you launch a comprehensive internal investigation, preferably with outside counsel, to determine the validity of any allegations and, if they are true, determine the most favorable outcome.

企业可以把合规疏漏作为真正建立或优化合规体系的机会并从中获益。这不仅将促进企业更快地重新获得世界银行和其他多边发展银行项目的准入资格,而且将有利于企业具备更好的条件来缓解与世行处罚引发的公共关系问题,满足大型跨国公司主办的其他国内、国外和国际法律法规的合规性要求,从而有助于跨国企业获得一个获益更多且低风险的未来。

Companies that use their compliance lapse as an opportunity to genuinely establish or enhance their compliance systems can reap a number of benefits. Not only will they only regain access to World Bank and other MDB projects quicker but will also be better equipped to mitigate the public relations issues related to the World Bank’s announcements, meet the compliance requirements for the host of other domestic, foreign, and international laws and regulations that large multinational companies find themselves subject to, and set their company on a more profitable and a reduced risk future.

《世界银行诚信合规指南》

责编:刘相文

作者简介

刘相文 律师

北京办公室 合伙人

业务领域:合规/政府监管, 诉讼仲裁, 收购兼并

王德昌

北京办公室 争议解决部

Graham·Adria

北京办公室 争议解决部

© 2019-2021 All rights reserved. 北京转创国际管理咨询有限公司 京ICP备19055770号-1

Beijing TransVenture International Management Consulting Co., Ltd.

地址:北京市大兴区新源大街25号院恒大未来城7号楼1102室

北京市丰台区南四环西路128号诺德中心2号楼5层

北京市海淀区西禅寺(华北项目部)

江苏省无锡市滨湖区蠡溪路859号2131室

深圳市南山区高新科技园南区R2-B栋4楼12室

深圳市福田区华能大厦

佛山顺德区北滘工业大道云创空间

汕头市龙湖区泰星路9号壹品湾三区

长沙市芙蓉区韶山北路139号文化大厦

梅州市丰顺县大润发大厦

欢迎来到本网站,请问有什么可以帮您?

稍后再说 现在咨询