As the global economy becomes increasingly digitalized, countries that successfully harness cutting-edge financial technologies (fintech) will gain a major advantage. An emerging fintech – digital currencies – is poised to play a particularly important role in the future economy. China is pioneering the creation of a central bank digital currency (CBDC) that is likely to be the first of its kind. If China succeeds in implementing a digital renminbi, it could generate significant economic and political dividends for Beijing, at home and abroad.

Over the last several years, fintech innovations like digital payment platforms have given large technology companies considerable influence within the Chinese economy. The rise of “cryptocurrencies” has presented additional challenges for Beijing. In response to these developments, the Chinese government has set out to establish a CBDC. The new digital renminbi, known as Digital Currency/Electronic Payment (DCEP), will function much like a digital form of cash and primarily operate via smartphones. If successful, it could be Beijing’s solution to keeping the renminbi competitive in the economy of the future.

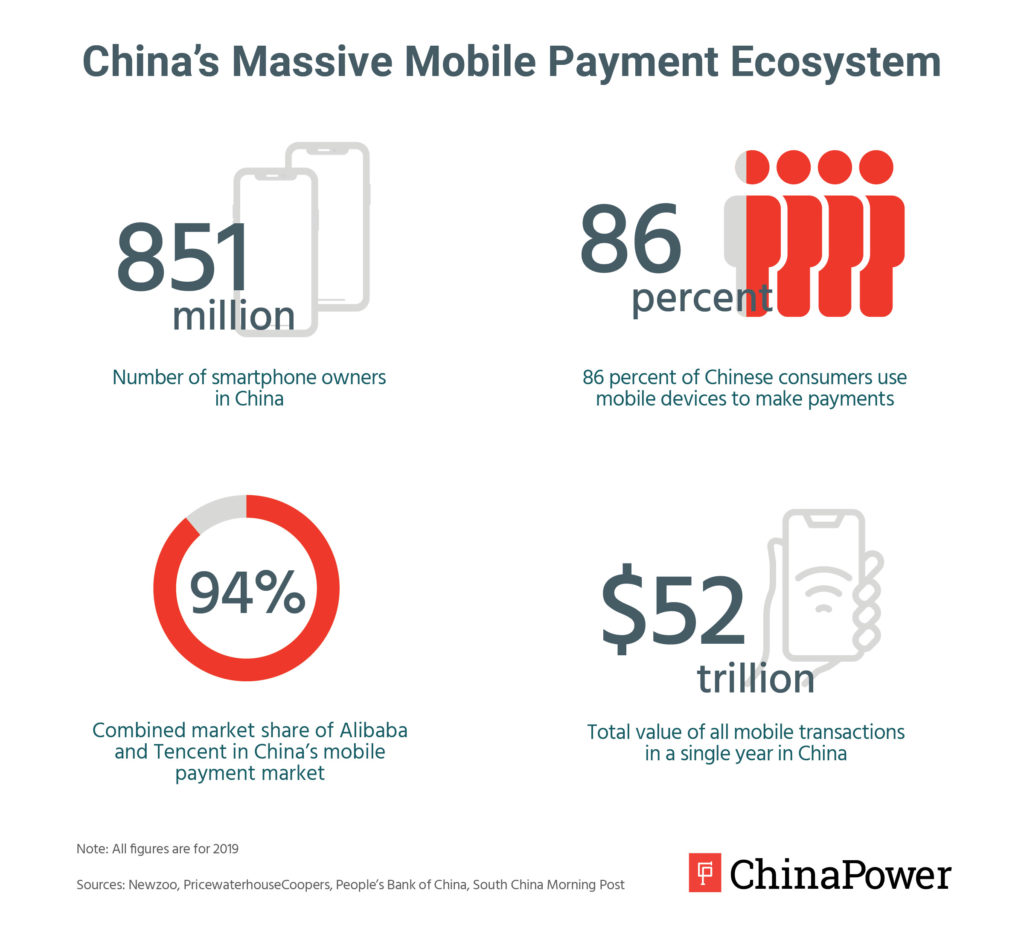

China has moved rapidly toward a cashless economy in recent years. This is largely thanks to mobile payment platforms like Alibaba’s Alipay and Tencent’s WeChat Pay, which act like digital wallets that allow users to make purchases in stores, pay bills, and transfer funds to other individuals. China leads the world in adoption of mobile payment technologies. According to a PricewaterhouseCoopers study, 86 percent of people in China used mobile payment platforms to make purchases in 2019. This was well ahead of Thailand, which had the second-highest percentage of mobile payment users (67 percent) and more than double the global average (34 percent).1

| Comparison of Mobile Payment Users | ||

|---|---|---|

| Global Rank | Mobile Payment Users (% of population) | |

| China | 1 | 86 |

| Thailand | 2 | 67 |

| Hong Kong | 3 | 64 |

| Vietnam | 4 | 61 |

| Indonesia | 5 | 46 |

| World Average | – | 34 |

| Source: PricewaterhouseCoopers | ||

While digital payment platforms have helped to facilitate commerce in China, they have placed much of the country’s money into the hands of a few technology companies. In the fourth quarter of 2019, Alibaba controlled 55.1 percent of the market for mobile payments in China. Tencent controlled another 38.9 percent, giving the two an effective duopoly over trillions of dollars in mobile payments.

People’s Bank of China (PBOC) Governor Yi Gang has made clear that these large companies pose “challenges and financial risks.” A hack or other disruption to their digital payment infrastructure, for example, could potentially cause serious short-term economic instability. Policymakers are also concerned that as Chinese citizens place their money in digital wallets instead of bank accounts, it is putting strains on commercial bank deposits and draining money out of the traditional banking system.2

China’s new digital currency is expected to be one tool with which Chinese authorities check the dominance of the technology companies that operate mobile payment platforms. In much the same way that cash makes its way from central banks to individuals, DCEP will be distributed through a two-tiered system. The PBOC will issue the digital currency to commercial banks, which will then provide DCEP to individuals. This system may help to reassert the role of the traditional banking system as the new digital renminbi competes with Alipay and WeChat Pay in the digital payment ecosystem.

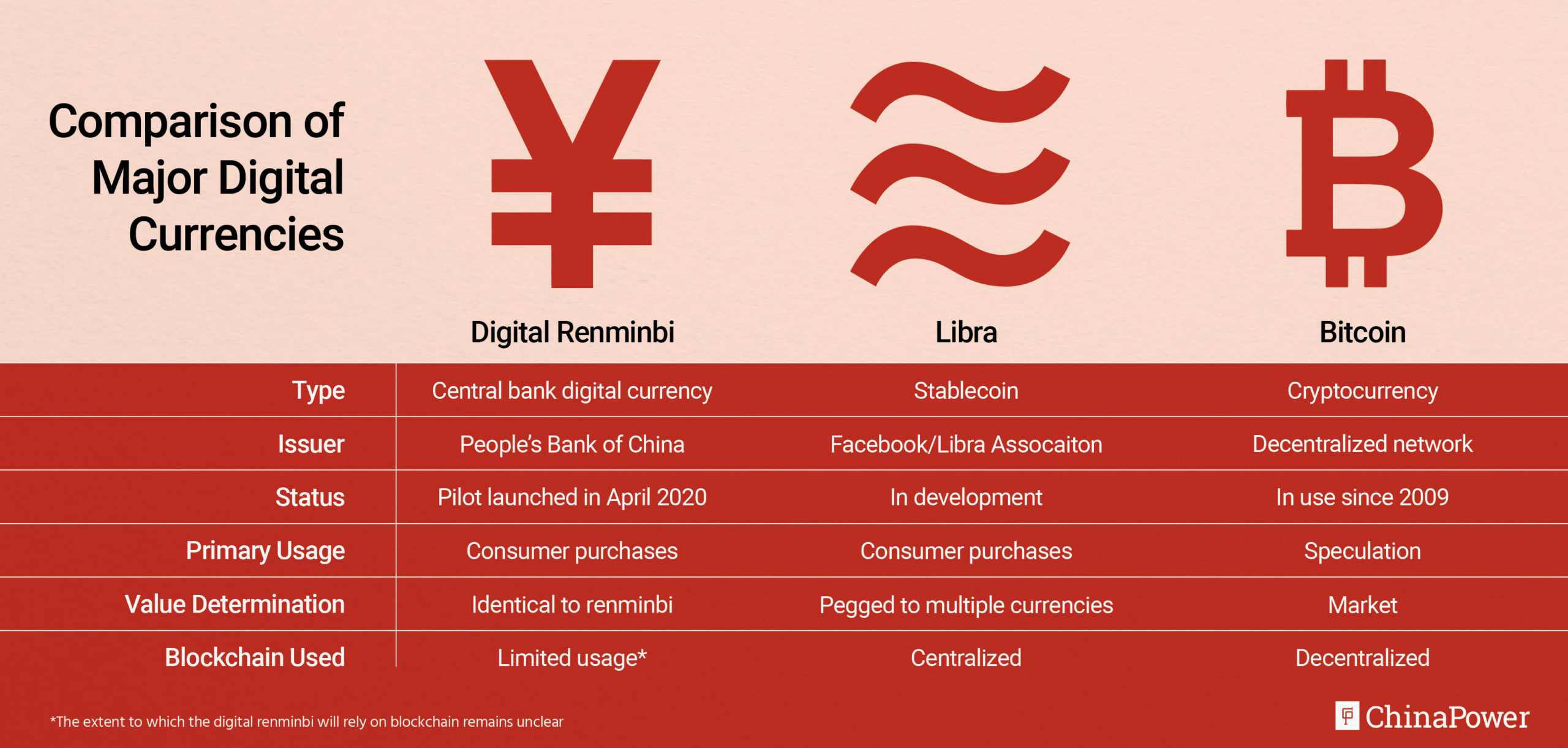

Beijing is also concerned about cryptocurrencies. Unlike third-party payment platforms, which are conduits for electronically transferring existing currencies, cryptocurrencies are entirely new digital currencies that operate outside of the control of government central banks. Since the first cryptocurrency Bitcoin launched in 2009, nearly 5,400 new cryptocurrencies have come into existence.

Bitcoin and most other cryptocurrencies rely on distributed ledger technology (namely blockchain), which allows users to make peer-to-peer transactions without going through a bank or other third party. Transactions are encrypted and generally processed by a decentralized network of computers rather than a single authority, providing users significant anonymity. Similarly, the value of Bitcoin and many other cryptocurrencies is set not by a central authority but by markets, which has made them appealing as speculative assets but led to very high price volatility.

Beijing has placed tight restrictions on cryptocurrencies. In 2013, the Chinese government restricted Chinese banks from using Bitcoin as currency, citing concerns about financial stability and the potential for Bitcoin to be used for illicit activities. India and Indonesia, among other countries, have instituted similar measures. Beijing cracked down again in 2017 with a ban on domestic initial coin offerings, which are an important means for bringing new cryptocurrencies online.

China’s concerns about cryptocurrencies received renewed attention in 2019 with Facebook’s announcement of Libra, a new cryptocurrency. Unlike Bitcoin, Libra will be a “stablecoin,” meaning it will be centrally administered and its value will be pegged to existing currencies. This is expected to make Libra far more practical for making purchases instead of serving as an asset for speculation. Beijing quickly grew concerned that large demand for Libra could lead to capital flight as individuals convert assets to the new digital currency. Chinese leaders also feared that Libra might crowd out usage of the renminbi in international payments.

Click the image to enlarge

By digitalizing the renminbi, Beijing is seeking to preempt Libra and other digital currencies that may challenge the status quo. If successful, the new digital renminbi will be a boon for China’s leaders, providing Chinese consumers with a digital currency while allowing Beijing to maintain its monetary authority.

Although China has not yet launched the digital renminbi nationally, it is far ahead of other major countries in rolling out a CBDC. As Beijing moves to launch DCEP, it will be aided by Chinese consumers’ familiarity with digital payment platforms, as well as the country’s state-led economic structure.

As of mid-2020, only nine other countries had begun CBDC pilot projects, with just two of these – Sweden and South Korea – being major OECD member countries. The United States and a dozen other OECD countries had begun researching CBDCs, and Canada was in the process of developing one, but the majority of OECD economies were not publicly working on a CBDC.3

| Breakdown of Global Progress on Establishing CBDCs (2020) | |||

|---|---|---|---|

| Phase of Work | Number of Major (OECD) Countries | Number of Non-OECD Countries | Total |

| Research | 13 | 8 | 21 |

| Development | 1 | 5 | 6 |

| Pilot | 2 | 8 | 10 |

| Launched | 0 | 0 | 0 |

| Inactive | 4 | 2 | 6 |

| Cancelled | 0 | 2 | 2 |

| Total | 20 | 25 | 45 |

| Source: Atlantic Council; Belfer Center for Science and International Affairs | |||

| Note: Includes only countries for which there is information. Updated as of August 2020. | |||

China’s central bank first set up a team to study digital currencies in 2014, and in 2017 China’s State Council issued an approval for the PBOC to begin designing the currency in cooperation with commercial banks. The PBOC also established a Digital Currency Research Institute in 2017, which has led work on the development of DCEP. In May 2019, PBOC Governor Yi Gang stated that “top-level design” of DCEP had already been completed and announced that initial pilot projects would take place in Chengdu, Shenzhen, Suzhou, and Xiong’an.

In April 2020, DCEP pilots were initiated in the four designated cities. In Suzhou, for example, some government workers were told to download a digital wallet app for DCEP. Images of what was claimed to be the digital wallet circulated widely on the Chinese internet at that time. In May 2020, those government workers in Suzhou began getting paid portions of a transportation subsidy in the form of DCEP.

China is expected to continue testing the digital renminbi in the coming months and years. PBOC officials have suggested that Beijing plans to showcase the currency during the 2022 Winter Olympic Games. Several major companies are also making plans to use the new digital currency. The ride-hailing app Didi Chuxing has entered into a “strategic partnership” with the PBOC that could eventually allow its 500-plus million users to pay for rides with DCEP. US companies like McDonald’s, Starbucks, and Subway are likewise slatedto be included in testing the new digital currency.

As China rolls out DCEP nationally, Chinese consumers may adopt it relatively easily given their familiarity with existing mobile payment platforms. It only took a few years for mobile payments to go from a novelty to widespread use. According to data from the PBOC, the amount of money that changed hands in China via mobile payments grew from RMB 11.7 trillion ($1.9 trillion) in 2013 to a staggering RMB 347.1 trillion ($51.8 trillion) in 2019.

China’s state-led economic model is likely to be another asset. Large commercial banks will serve as crucial intermediaries connecting the PBOC to individuals. Four of China’s largest and most important commercial banks are state-owned, meaning that they are tightly aligned with Beijing’s policy priorities.4 Reports suggest that employees at these four banks are already testing the digital renminbi, using it to transfer funds and pay bills. As China moves closer to nationwide adoption of DCEP, these institutions will play a critical role in constructing and maintaining the digital infrastructure that allows the digital currency to function.

If the Chinese government is able to popularize the use of DCEP, it could gain significant economic and political benefits at home. DCEP could also help boost the internationalization of the renminbi, which is a key long-term goal of China’s leaders.

Beijing’s plan is for DCEP to eventually replace a significant portion of the physical money in circulation.5 Doing so would reduce the costs of securing and maintaining physical cash supplies, which could free up 0.5 percent of China’s GDP. There are, however, expected to be new costs associated with establishing and securing the digital infrastructure that allows DCEP to function.

DCEP is expected to operate without the need for a bank account or the internet, which could bring new sources of economic growth and opportunities for greater financial inclusion.6 As of 2017, 20 percent of Chinese adults (225 million people) did not own a bank account, which is required to access many institutional financial services and to use mobile payment platforms. DCEP could open up new avenues for institutions to provide services for borrowing, saving, and investing to these individuals. Moreover, DCEP can attract new users to China’s thriving e-commerce market. In 2020, the Chinese e-commerce market is estimated to be the largest in the world, at nearly $2.1 trillion. This is well over twice the size of North America’s combined e-commerce market and more than three times the size of Europe’s.

| Breakdown of the Global E-commerce Market (2020) | ||

|---|---|---|

| Country/Region | Value (Billions of US$) | Global Share (%) |

| China | 2,090 | 53.4 |

| North America | 749 | 19.1 |

| Europe | 591.2 | 15.1 |

| Asia-Pacific (excluding China) | 358.3 | 9.2 |

| Rest of World | 125 | 3.2 |

| Source: eMarketer | ||

A digital renminbi would also enhance the government’s capacity to monitor and control economic activity. When individuals use DCEP, real-time data about the transaction will be available to Chinese authorities. This could better enable authorities to combat illicit activity and reduce corruption, but it also poses serious concerns about privacy. DCEP could, for example, aid the government in tracing activities deemed socially undesirable, such as gambling. Observers have postulated that this behavioral information can even be connected to the social credit system, a national system that aims to track citizens’ reputations.

Data gleaned from DCEP will also give Beijing an unprecedented level of detail into the status of China’s economy, allowing policymakers to set more nimble and tailored monetary policies. With a traceable digital currency, it might be possible for the government to designate the specific kinds of purchases that can be made. For instance, if the government issues economic stimulus payments directly to citizens only in DCEP, it can earmark the money to be used only for necessities like housing and food.

Beyond China’s borders, DCEP could help facilitate the internationalization of the renminbi. According to the Society for Worldwide Interbank Financial Telecommunication (SWIFT), the world’s largest international electronic payment system, the renminbi was only used in about 1.9 percent of all international payments in July 2020. By comparison, the US dollar and the euro were used in 38.8 percent and 36.5 percent of transactions, respectively.

China has been pushing for years to establish a greater foothold in the international payment space. In October 2015, China launched its Cross-border Interbank Payment System (CIPS) as an alternative to SWIFT. If China can successfully establish a new international payment architecture centered around the digital renminbi, Beijing may gain a new avenue for promoting international usage of its currency. To do this, the Chinese government could share their technological expertise to help other countries build their own digital currencies, and develop a network of digital currencies that are interoperable with DCEP.

With the proper international payment infrastructure in place, China could promote the internationalization of the renminbi by incorporating DCEP into various forms of economic activity. Beijing could, for example, provide financial aid to other countries in the form of the digital renminbi. It could also push to incorporate DCEP into cross-border payments related to Belt and Road Initiative projects, and in bilateral trade. China has already begun to push the use of the physical renminbi – instead of the dollar – in bilateral trade withPakistan and Turkey.

China’s emergence as a global economic power has only modestly boosted the standing of the renminbi internationally. What steps is Beijing taking to try to shake up the global currency hierarchy? Find out.

While DCEP could aid renminbi internationalization in many different ways, much still hinges on Chinese financial policies. Many of the fundamental concerns about the renminbi have still not been addressed. China continues to impose strict control on capital flowsacross its borders and Beijing maintains a tight hold over the renminbi exchange rate. These policies guard China against global financial volatility, but they also decrease the renminbi’s attractiveness as a means of exchange and a store of value. Until these underlying concerns are addressed, more established currencies like the US dollar, euro, and yen will continue to be the safest bet for most international actors.

中国将竞争转向数字支付领域

近年来,数字支付平台等金融科技创新,已经使大型科技公司在中国经济中产生了相当大的影响力。而“加密货币”的崛起又给中国带来了额外挑战。为了应对这些情况,中国政府已着手创建央行数字货币(CBDC)。新的数字人民币称为数字货币/电子支付工具(DCEP),其功能类似于数字现金,主要通过智能手机进行操作。如大获成功,则其将成为中国人民币在未来经济中保有竞争力的制胜法宝。

数字支付平台

近年来,中国迅速向无现金经济迈进。这在很大程度上要归功于阿里巴巴的支付宝和腾讯的微信支付等移动支付平台。这些平台类似于数字钱包,用户可借此在商店购物、支付账单以及向他人转账。中国在采用移动支付技术方面处于世界领先地位。据普华永道的一项研究,2019年,中国境内有86%的人使用移动支付平台购物。这远远超过了移动支付用户比例第二高的泰国(67%),并且比全球平均水平(34%)的两倍还多。

© 2019-2021 All rights reserved. 北京转创国际管理咨询有限公司 京ICP备19055770号-1

Beijing TransVenture International Management Consulting Co., Ltd.

地址:北京市大兴区新源大街25号院恒大未来城7号楼1102室

北京市丰台区南四环西路128号诺德中心2号楼5层

北京市海淀区西禅寺(华北项目部)

江苏省无锡市滨湖区蠡溪路859号2131室

深圳市南山区高新科技园南区R2-B栋4楼12室

深圳市福田区华能大厦

佛山顺德区北滘工业大道云创空间

汕头市龙湖区泰星路9号壹品湾三区

长沙市芙蓉区韶山北路139号文化大厦

梅州市丰顺县大润发大厦

欢迎来到本网站,请问有什么可以帮您?

稍后再说 现在咨询